Bitcoin recently surged to a new all-time high of $111,861 before briefly dipping to around $110,300 and then rebounding. Despite this impressive rally—outpacing the Dow Jones Industrial Average—there’s been no significant wave of profit-taking, suggesting confidence remains strong in the crypto market.

Is Bitcoin Overheating? Experts Say Not Yet

Interestingly, all Bitcoin addresses are currently in profit, yet on-chain data suggests the market isn’t overheating. According to CryptoQuant analyst Crypto Dan, typical signs of overheating—like high funding rates and short-term capital inflows—remain subdued compared to previous bull runs. This indicates that short-term investors aren’t rushing to cash out just yet.

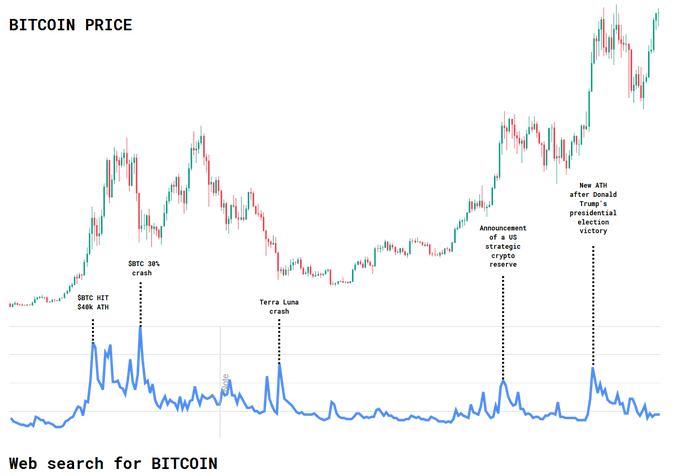

Crypto investor Alex Wacy echoed a similar sentiment. In a post on X, he noted that despite Bitcoin reaching new highs, retail investors haven’t shown typical “FOMO” behavior. Google search trends remain low, pointing to a lack of widespread excitement—often a precursor to market bubbles.

Money Supply Hits Record Levels as Bitcoin Eyes Further Gains

Another factor potentially fueling Bitcoin’s rise is the record-high global M2 money supply, now over $22 trillion. Wacy noted this excess liquidity isn’t matched by an increase in real-world productivity or output—just “more money” in the system. This, he suggests, could further support Bitcoin’s upward trajectory.

With Bitcoin now in price discovery mode, many analysts believe the rally is far from over. Wacy projects BTC could hit $150,000 or more in 2025. On May 21, 2025, Michael Saylor emphasized that even buying at the current top might prove profitable in the long run.

Whale Moves Signal Continued Confidence in BTC

In a notable on-chain move, a crypto whale who recently acquired 30,000 ETH and 600 BTC on April 27 has sold all of their ETH holdings—yet continues to hold onto the entire Bitcoin stash. The 600 BTC, initially purchased for $56.9 million, are now worth over $66.5 million as Bitcoin trades above $111k.